I’m not sure if it was a coincidence or whether it is rewards season. But I received emails from my electricity, telco and insurance providers over the past 2 weeks promoting their member benefits programs. What stood out to me the most after reviewing all three emails, is that if you removed the branding and only looked at the offers and discounts, then they are all similar. This got me thinking about the value of these member benefit programs. And why organisations struggle to differentiate themselves from the pack.

What is a member benefits program?

A member benefits program is a structured program offered by organisations to provide their members with access to a range of offers. These include discounts, bonus deals, or special pricing. Offers are redeemed by presenting a membership card or vouchers, calling a dedicated phone number, or by accessing a website or app.

Member benefits programs have been a popular choice over the last twenty years. As many companies do not earn sufficient margin, or do not have customers spending enough at an individual level, to support a loyalty currency program or status tier program.

Creating a member benefits program

The benefits within the program can be provided by the company, but more often tend to be sourced from third-party partners. And this is where the main challenges lie. Establishing partnerships and accessing a range of offers, can be very time consuming and expensive. This is why many businesses engage third-party aggregators to set this up for them.

Over time, numerous aggregators have developed to offer both a white-labelled transaction platform and a selection of offers. Established through partnerships with third-party entities like gift card providers, cinemas, travel brands, and experience companies. This presents a readymade program, saving program operators considerable time and effort in negotiating and establishing offers. Aggregators usually impose either a per-member annual fee or a fixed-rate annual fee for a specified number of members.

Eliminating the necessity for a platform to oversee member accounts and currency balances, can result in substantial reductions in technology costs. Furthermore, the cost per member can be significantly lower. For instance, a points program might yield returns ranging from 1 to 10 percent for the member. Whereas a member benefits program may incur only a fraction of a percent of customer spend. Despite this, and contingent on the provided benefits, members may access greater value compared to loyalty currency programs. Fostering heightened program engagement. When partnerships are established with sought-after brands, the company may experience a halo effect, with members perceiving it more favourably.

Member benefit Program Design Variations

In exploring member benefits programs, three design variations are considered; company-provided, supplier-provided and third-party provided.

Company-provided member benefits program

In this framework, members gain access to appealing benefits provided by the company itself. The strategic focus is on presenting members with a bundle of valued benefits that incur minimal costs for the company. These benefits may encompass complimentary samples, extended warranties, charitable donations. And other perks designed to incentivise members to identify with the program during transactions or to reduce their likelihood of switching. Developing a loyalty program with universally appealing benefits proves challenging for most companies.

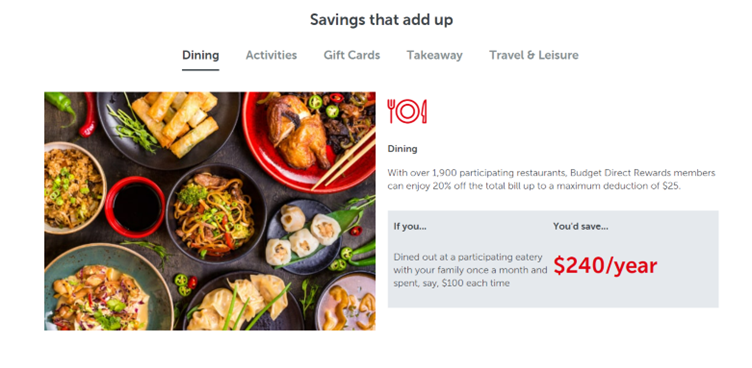

Case Study – IKEA Family1

Members are prompted to swipe their card at the checkout for each transaction. Unlocking a diverse set of benefits that vary by country. These may include complimentary insurance covering product transport from store to home. An extended returns policy, entry into a draw for IKEA gift cards, and a modest donation to a local charity. The bundled benefits create a perception of value for members, encouraging them to consistently use their membership card. Enabling IKEA to collect valuable transaction data.

The program’s operational cost represents a negligible fraction of revenue per member. The likelihood of members returning a product after the standard non-member 3-month returns policy is minimal. Claims related to store-to-home insurance are estimated to be minimal. Gift card prizes incur modest costs for each store. But potentially stimulate additional revenue by encouraging members to spend beyond the card’s value. The capped charity donation allows IKEA to manage costs effectively. As once the limit is reached, member card swipes no longer contribute to donations until the reset at the year’s end.

Supplier-provided member benefits programs

Certain companies are fortunate enough to access product samples from suppliers. Which some have incorporated into loyalty programs. Accessing free samples is a great way for members to try new products without having to commit to a purchase. Members receive access to a selection of relevant samples on a regular basis, combining the delivery of value with surprise and delight. As members do not know what they will receive. This enables a dynamic where the member places a high value on a reward which costs the company little.

Case Study – Priceline Sister Club2

Priceline Sister Club program is the rewards program of Priceline, with over 8 million members. Priceline Sister Club is primarily a points-based program; however they have introduced tiers which unlock a number of benefits including access to secret sales, VIP events and competitions. The most valuable reward advertised, to which all members are encouraged to strive for, is the Pink Diamond Gift which is available to their highest tier Pink Diamond Members.

The Pink Diamond Gift is a complimentary gift box provided every quarter and containing 3-4 sample products. The samples are provided by Priceline suppliers who use this as an opportunity to get their brand and product lines in front of the company’s most engaged and loyal shoppers.

Third party-provided member benefits

When internal sourcing or supplier samples are unavailable for benefits. A company may establish partnerships with various third-party entities to offer member benefits. Representing the most prevalent design in the market. While internally provided member benefits programs, exemplified by IKEA Family, are notable for their cost efficiency. Those relying on third-party providers can incur higher expenses, especially when seeking exclusive, best-in-market offers. Securing such offers may involve annual licensing fees, reciprocal marketing support, and other concessions. For instance, a company aiming to grant its customers access to discounted event tickets might need to pay an annual fee to the ticketing partner for rights, along with promoting specific events to its member base.

Case Study – O2 Priority3

O2, a UK telecommunications company, delivers a rotating array of benefits to members across more than 30 exclusive categories. Including discounted event tickets, complimentary bags of chocolate, discounts at major brands like The Body Shop, free cookies and crisps, complimentary Uber rides, and substantial discounts on new technology. The periodic change in offers maintains their freshness. Enticing members to consistently check in to ensure they do not miss out on any bargains.

Challenges

Member benefits programs also provide a range of challenges for program operators.

- Firstly, when customers can access all available benefits merely by registering. The potential to leverage the program for driving behavioural change diminishes. Without members progressing along a goal-oriented pathway, the endowed progress effect and goal gradient effects cannot materialise.

- Secondly, the paramount factor influencing member engagement is the quality of the benefits. If these benefits are perceived as substandard or easily accessible through alternative means. Such as other programs in the example I witnessed, it adversely impacts engagement. Acquiring attractive and desirable benefits can be challenging. Often involving extensive negotiations and, at times, monetary payments. Thereby increasing the operational costs of the program. Additionally, securing exclusive benefits for a competitive advantage may incur even higher costs, as seen in the O2 Priority case study. Another good example of this is Optus and Telstra, who have both secured exclusive movie ticket pricing through Hoyts and Event Cinemas, respectively.

- Thirdly, communicating these benefits can be intricate. Members must not only be aware of the available benefits but also actively consider and select them to engage with the program, necessitating a sustained marketing effort. Program operators may face competition with their company’s product managers for limited marketing resources, making it difficult to achieve the necessary promotional volume for effective communication. This challenge intensifies without adequate segmentation, which allows tailoring the marketing message to specific groups, and in the absence of highly desirable benefits.

- Finally, it can be challenging to capture member transaction data. In instances where the benefit is provided by a third-party partner, the loyalty program operator may not be able to track when a transaction has occurred, denying them a valuable source of data which could be used to better profile members.

In Summary

I can see why large insurance, utility and telco companies go with a traditional white labelled member benefits program. As it provides a breadth of offerings that support a varied demographic member base.

The concern I have with this is that we are all customers of these types of companies, hence, we are most likely members of a similar benefits program with similar offerings already. This can lead to program saturation, where consumers may be overwhelmed by the sheer volume of loyalty programs being promoted to them. It’s difficult to build brand advocates via this program, if they can already get it somewhere else or directly through a competitor.

I would like to see companies’ source more offers for their members directly from a brand. This doesn’t mean they need to spend millions to secure these discounts, like Optus and Telstra. If you can show another business the synergy between your brands and target market, this can go a long way to securing a partnership. This is one way to stand out in this space and gain best in market offers for your members.

Looking for consultants to design your loyalty program?

Our loyalty consultants have helped global brands take the critical steps to design unique and effective loyalty programs, as well as support ongoing evolution to meet changing business and consumer expectations. Contact us to learn more about our comprehensive loyalty services and talk with our loyalty consultants to understand how to develop or optimise your loyalty program strategy.

Footnotes

- IKEA, https://ikea.com/au/en/ikea-family/ ↩︎

- Priceline, https://www.priceline.com.au/sister-club ↩︎

- O2 Priority, Priority: Our pick of the best offers and prize draws. – Priority – Priority (o2.co.uk) ↩︎