I recently binge-watched the Netflix series “Pepsi, Where is My Jet?“. A show that takes us back to the ’90s when Pepsi launched an ad campaign to promote a points program called “Pepsi Stuff”. Sunglasses, leather jackets, caps, duffle bags and more goodies could be redeemed with “Pepsi Points”, which could be accrued by buying the soda.

As a loyalty consultant, I was immediately hooked. The thing is that “Pepsi Stuff” included a jaw-dropping Harrier fighter jet which was worth $23 million (equivalent to a whopping $37 million in today’s money) and it could be redeemed with 7,000,000 Pepsi Points. It was meant to be a joke, but it ended up in a costly lawsuit.

John Leonard, a clever 21-year-old college student, calculated he needed to drink 190 Pepsi cans a day for 100 years to attain the 7 million Pepsi points… but he also realised that Pepsi allowed to purchase Pepsi Points for 10 cents each. Crunching the numbers 7 million points was US$700,000. Much less than the Harrier Jump Jet, and less effort. So he found an investor.

As per program rules, Leonard then mailed Pepsi’s headquarters 15 Pepsi Points worth of physical tags from Pepsi products, along with a check for $700,008.50, including $10 shipping costs. You can imagine the circus after Pepsi received the claim.

Spoiler alert: Pepsi flatly denied Leonard’s request, asserting that the commercial was merely a tongue-in-cheek jest. Moreover, executives pointed out that the jet was not an item offered in the Pepsi Points catalogue.

To the utter demise of all who supported Leonard, Pepsi won the case, cementing the fact that no one in their wildest dreams would take an offer like this seriously. Leonard argued it was a genuine offer as he took all steps to verify its authenticity. But Pepsi referred to the promotion of the Harrier jet in the commercial as “fanciful” and stated it intended to create a “humorous and entertaining ad”.

The Leonard vs Pepsico saga continues to be a popular case study in law schools, fueling debates and offering valuable lessons. Advertisers and their agencies have also learnt not to air anything without proper terms and conditions. Yet, what about the loyalty industry? What insights can we gather from this extraordinary story?

It is difficult to establish whether Leonard truly believed the Harrier jet offer was genuine or he opportunistically wanted to exploit a loophole which proved to be defensible.

However, in the show, Leonard’s portrayal of his reaction to the Pepsi Stuff commercial highlights the fact that people participate in programs because of the promise of value and continue to engage because they perceive they will keep receiving value from the brand.

It is clear that the financial value Leonard saw in the jet encouraged him to engage; to the extent of starting a whole operation to try to buy 7 million bottles and looking for an investor. Although value means different things to different people, in loyalty programs, value is typically delivered through financial advantages like discounts, free products or services, bonuses, or cashback.

Value could also be accessed to member-only products or services, perks such as access to lounges and exclusive events, special gifts, unique content, or priority privileges.

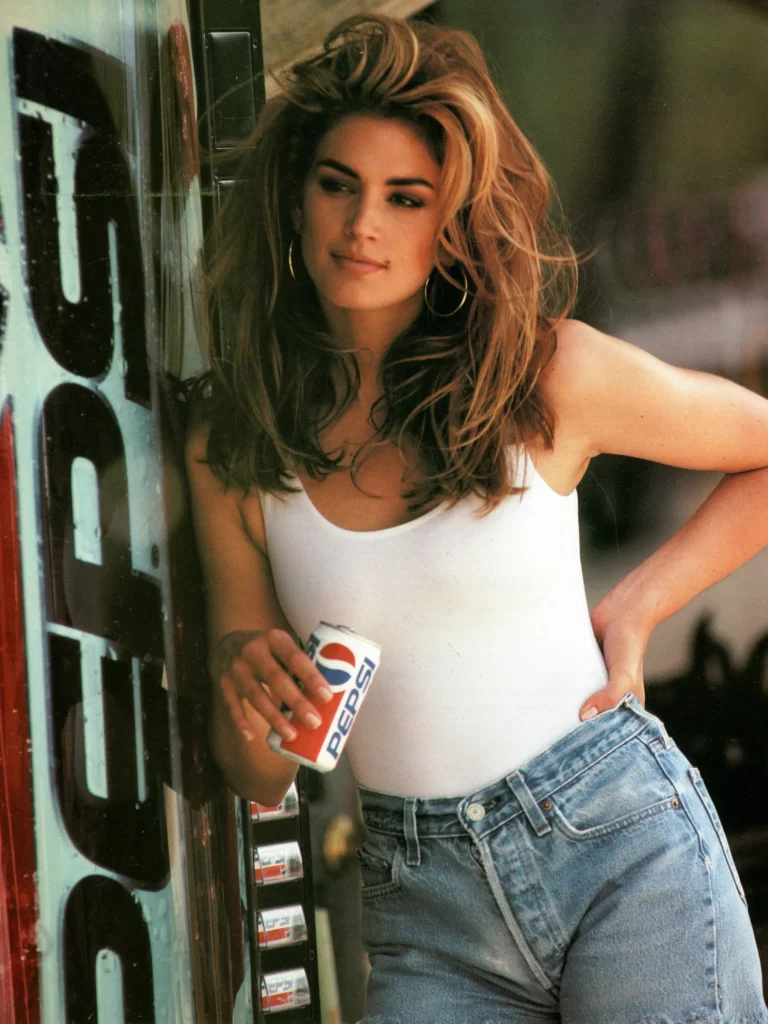

Additionally, value could manifest through the positive impact or influence surrounding a brand. For example, in the ’90s, Pepsi had also introduced the Pepsi challenge, enlisting renowned celebrities such as Cindy Crawford and Michael Jackson. Their fashion and their endorsement of Pepsi influenced brand perception. Ultimately making Pepsi Stuff highly desirable items for fans.

Think wearing a t-shirt (75 points), aviator style sunglasses (175 points) and a leather jacket (1,450 points)… it would give you some serious 90’s cred. Owning a Harrier jet (7,000,000 points) would make you the coolest kid ever. Understandably, Pepsi assumed that 7 million points for the military aircraft was so high that it was enough to indicate that it was a joke. Here is why.

Consumers use mental shortcuts, such as heuristics, to assess the value of rewards in a loyalty program. Biases can arise when these heuristics lead to systematic errors in decision making, affecting consumers’ perceptions and choices. Understanding these psychological factors is crucial for loyalty program designers and operators to influence consumer behaviour effectively.

A great example is the ‘Representativeness Heuristic‘, identified by Kahneman & Tversky in 1972[1], which occurs when comparing and categorising objects based on similarities rather than objective knowledge. For instance, consumers misjudge the relationship between value and size, mistaking ‘lots’ for ‘big’. Hence, a pile of one thousand 1 cent coins may appear larger than a ten-dollar note due to this heuristic.

Points and miles programs employ the representativeness heuristic to create the perception of value in a reward, making it appear larger than it actually is. If a member spends $100 with a retailer and receives a 1 percent reward, it is a $1 return. However, in a loyalty program, earning 100 points, valued at 1 cent each, may be perceived as larger than $1 due to the representativeness heuristic.

As humans, we are not good at judging the size of large numbers, and 7 million sure does sound big. But likewise 1 million or 10 million. In an effort to protect itself, Pepsi amended the ad with the Harrier value at 700 million Pepsi Points.

I find this amusing, it’s not like 700 million was funnier. Pepsi just didn’t bother to do the maths in the first place when choosing an arbitrary large number. This emphasises that it is paramount for loyalty programs to be underpinned by a robust commercial model.

Pepsi may have calculated covering the costs associated with t-shirts, sunglasses, and jackets through the incremental sales or the option for fans to purchase points at .10 cents each. However, the program failed to leverage a commercial model that could have sparked creative alternatives to entice customers with genuinely appealing items they could obtain, rather than offering an unrealistic military aircraft.

Many loyalty programs are a direct cost to the company; viewed as marketing investment to boost customer engagement, leading to profit growth, reduced churn, and positive financial and brand outcomes. However, some programs generate direct incremental revenue, offsetting operational costs or operating profitably. Many loyalty programs can be structured to be profitable and generate income, considering value to customers and program partners.

Some methods include bringing in third-party partners paying for members to earn points, earning revenue for selling membership subscriptions, earning commission when selling discount products to members, earning merchant funded revenue via member transactions or selling and supplying program-branded products and services.

Leonard meticulously calculated every aspect, which is not uncommon for engaged members seeking to derive maximum benefit from a program. Regrettably, the pursuit of extracting value extends beyond enthusiastic program participants. Loyalty programs are constantly targeted for fraudulent activity. This also emphasises that implementing security measures and fraud risk mitigation strategies to protect a program is crucial.

Needless to say that Pepsi should have established proper terms and conditions and conducted thorough due diligence. We all agree that any loyalty program should be underpinned by comprehensive program rules and disclaimers. These, to protect the company from any potential contentious issue, operate within the law, and protect consumers’ privacy and legal rights. But due diligence goes beyond and companies must ensure there are no loopholes in their program design.

Today, security breaches and fraudulent activity are extensive in loyalty programs. With an estimated US$320 billion of value sitting in points accounts around the globe, and many loyalty program operators not taking necessary steps to properly address security risks, account hacks and fraud continue to be perpetrated.[2]

While security protocols provide the best opportunity to prevent fraud from happening, if (or when) it does happen, effective member behaviour and data monitoring processes will enable instances to be quickly identified, neutralised and prevented from occurring again.

To mitigate security and fraud risks, program operators want to quickly identify unusual earn and redemption activity, accounts created by bots, account take-over instances, and even database breaches.

The first Pepsi Stuff points program launched in the US in March ‘96 and then to the world. It ended in October same year and was relaunched 12 years later in February 2008, for eleven months. In 2015 the program was re-designed as Pepsi Pass; an app that connected to Facebook to collect points and Pepsi Dollars to unlock prizes like concert tickets, exclusive event invites and even win trips. Pepsi Stuff came back in 2018 with retro editions of Pepsi items. Today, around the world, Pepsi has various programs managed by different business divisions.

Hopefully, Pepsi is applying loyalty program best practices this time round. Here are some interesting Pepsi loyalty programs that have been launched around the world.

[1] Kahneman, D. &Tversky, A., 1972, ‘Subjective probability: A judgment of representativeness’, Cognitive Psychology, Vol 3, Iss 3, pp430–454.

[2] Phil Shelper, 2020, “Loyalty Programs: The Complete Guide”, pages 228 and 236