Globally, a small number of coalition loyalty programs are highly profitable, with their annual billings in the billions and profits in the hundreds of millions, or even billions. According to IdeaWorksCompany,[1] in 2017, American Airlines generated US$3.1 billion from AAdvantage program points sales, while Delta SkyMiles generated US$3 billion, and United MileagePlus generated US$2.3 billion.

The United MileagePlus June 2020 Investor Presentation[2] stated the program had over 100 million members, US$5.3 billion in cash flow from miles sales in 2019 (12 per cent of total United revenue) and US$1.8 billion EBITDA (26 per cent of total United adjusted EBITDAR). Of interest, due to the massive impact of Covid-19 on the airline industry globally, United obtained a US$6.8 billion financing commitment through a financing structure secured by MileagePlus, indicating the critical importance of the loyalty program to the airline.

Coalition loyalty programs generate billings when a partner company pays for a member to earn points. For example, if an Emirates Skywards member hires a car from Sixt, they will earn 2,000 miles. Emirates will invoice Sixt for the cost of those miles. Sixt will view the cost as a marketing expense, because by offering Skywards miles, Sixt is more likely to attract Skywards members, plus Emirates may promote them to their member base, helping to boost sales.

Coalition loyalty programs generate revenue when the member earns points, redeems points, when points expire, and when interest is paid on deferred billings.[3]

To illustrate the coalition loyalty program monetisation model, consider this hypothetical example.

- A member of a coalition loyalty program spends $10,000 with participating retailers (this may be a single transaction or multiple transactions). They swipe their membership card and earn 10,000 points at the rate of 1.0 point per dollar spent. The coalition loyalty program invoices the retailer/s for the cost of the points at a rate of 1.5 cents per point, costing the retailer/s $150.

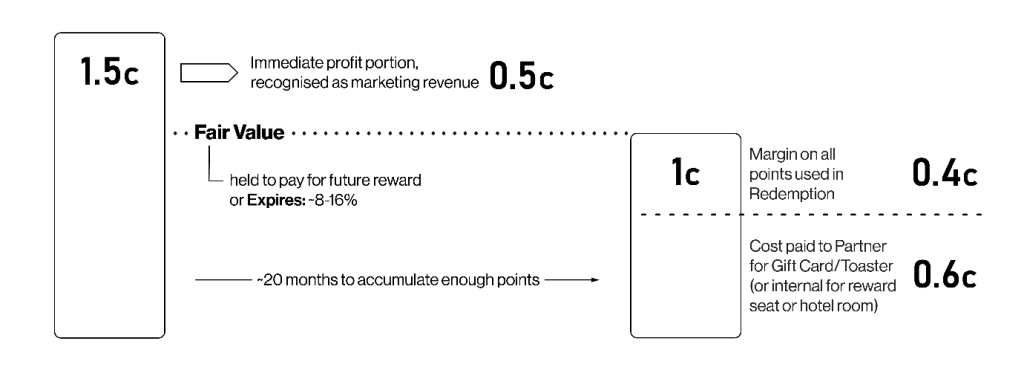

- The $150 billings earned is transferred to a holding account. International accounting standards dictate the program operator must hold sufficient billings to cover the cost of the future points liability (referred to as ‘Fair Value’). In other words, the program operator must retain enough cash to cover the cost of the reward when the member decides to redeem the points. For our example, the Fair Value is 1.0 cent per point, so the extra 0.5 cent can be recognised immediately as revenue (IFRS13 refers to this as marketing revenue, while under US-GAAP this is done through a bifurcation clause in the partner contract). The 1.0 cent per point is transferred to the Balance Sheet and added to a Deferred Liability account. It is held there until either the points are redeemed or they expire.

- When the member redeems the points, the coalition loyalty program may assign a lower value than the 1.0 cent held as Fair Value for the points. In this example, the member will redeem their points for a gift card, where the value per point is just 0.6 cent. Thus, the program operator will earn an additional 1.0c – 0.6c = 0.4c per point. The program recognises both the 1.0 cent as redemption revenue (removing it from the Deferred Liability account on the Balance Sheet) and the 0.6 cent as a redemption expense, thus reflecting the marginal profit of 0.4 cents in the Profit and Loss.

- If the member does not have any further account activity or does not redeem the points within a specified time period, the points may eventually expire. In this instance, the program operator will earn the full 1.0c per point as revenue.

The below diagram reflects the timing of recognising various parts of the point value through its lifecycle:

A large coalition loyalty program can sell hundreds of billions of points each year, making those fraction of a cent profits quickly add up.

The below table illustrates the calculations for the example:

| Action | Earn/Redeem/ Expire | Net Points Balance | Billings/Cost Paid | Revenue |

| Member spends $10,000 | Earn 10,000 points | 10,000 | 1.5c x 10,000 points = $150 | 0.5c x 10,000 points = $50 |

| Deferred revenue earns interest | $100 x 3% p.a. = $3.00 | |||

| Member redeems for a $50 gift card | Redeem 8,000 points | 10,000 – 8,000 = 2,000 | Paid – $48 | 8,000 x (1.0c-0.6c) = $32 |

| Remaining points expire | Expire 2,000 points | 2,000 – 2,000 = 0 | 2,000 x 1.0c = $20 | |

| Total | Net $102 | $50 + $3 + $32 + $20 = $105.00 |

Thus, for a transaction of $10,000, the loyalty program operator collects billings of $150. Of that amount, $105 revenue is earned with $48 paid in cost to provide a reward.

Coalition loyalty program operators may price discriminate by offering volume discounts to third-party partners. Smaller retailers buying fewer points each year can expect to pay more per point than larger retailers buying more points. Some retailers may agree to provide multiple points for each dollar spent by the member, so they end up investing a larger percentage of the member’s spend on points.

Loyalty program operators may also negotiate with the third-party partner to commit to rewarding their customers with a minimum amount of points each year to ensure they are fully committed to promoting the partnership within their marketing channels. In return, loyalty program operators may agree to specified marketing promotion of the partner to their member base to help them grow their business. Loyalty program operators may also negotiate for the partner to commit to running a number of bonus points campaigns each year. In some instances, the cost of the bonus points to the third-party partner may be higher than standard points in order to cover the campaign marketing costs of the loyalty program, while acting as an incentive for the program to run the campaign.

As detailed in the example, if the member does not redeem or transfer the points, they may expire (which is known as ‘breakage’ in the loyalty industry). This may be because the member has had no account activity for a specified period, meaning they have not earned or redeemed at least one point in the required time frame. For example, miles in the Air France/KLM Flying Blue program expire if members have no qualifying flight or credit card activity on their account within a 24 month period.[4] Alternatively, points may expire because a specified period of time has passed from when the points were earned. For example, Singapore Airlines Krisflyer miles expire after three years at the end of the equivalent month in which they were earned.[5]

The expiry of points is a key factor in the financial management of a coalition loyalty program’s profitability, with both push and pull factors. Higher levels of expiry directly translate into higher immediate revenue.[6] However, it also represents members disengaging from the program, hence can have a negative impact on the future profitability potential of the program. Due to this, some coalition loyalty programs engage actuaries to help manage their expiry strategies, with the aim of maintaining it within a specified percentage range.

| Qantas Frequent Flyer A Qantas Frequent Flyer presentation to the Actuaries Institute in 2012 stated that within the loyalty program, ‘modelling future points expiry (breakage) helps inform the setting of assumptions by management,’ and that ‘breakage is modelled with a multi-state transition model based on the level of customer activity.’[7] |

This issue of points expiry has also attracted the attention of regulators, with some countries acting to outlaw the practice in the interests of consumer protection.

| Ontario Government In 2018, the Government of Ontario, Canada, legislated a ban on loyalty and reward points expiry as part of a series of consumer-side protections, allowing consumers to request that businesses reimburse them for improperly expired points.[8] These consumer protection laws do not come into play if the loyalty program operator decides to close a member’s account due to reasonable grounds of inactivity or fraud. |

Some loyalty program operators aim to maximise the profit they make on each point which is sold and redeemed. They may do this by adjusting the price and value of points. Depending on what reward a member redeems their points on, the value they receive for their points can vary. For example, points redeemed on a flight may deliver a value of 1 cent per point but if redeemed on a gift card (as per our example) they may deliver a value of 0.6 cents per point, while a toaster may give just 0.25 cents value per point.

This approach utilises efficient rewards to maximise the value accessed by members for flights, ensuring the majority of points revenue remains within the airline. The approach also takes advantage of wholesale margins on third-party products to boost revenue earned on redemptions. To further boost revenues, some airline programs have been observed to apply surcharges on reward flights which are not applied on flights paid for with cash.[9]

Other loyalty program operators take a more balanced approach; attempting to maintain as much of a value return as possible for members, with the outcome being lower program profits but (ideally) higher member engagement.

As illustrated, the coalition loyalty program operator also earns interest on deferred billings. When the points are sold to third-party partners, the loyalty program operator must defer enough to cover the cost of the future reward (or liability)[10]. A deferred holding of several billion dollars is not unusual for a large loyalty coalition program.

These types of programs are very complex to design, implement and operate, meaning specialist loyalty consultants are a critical resource to ensure it is executed correctly.

Long live points!

Ready to start your own successful loyalty program? Our team of expert loyalty consultants can help you design a program that drives revenue and customer retention. Contact us today to learn more about how to design the perfect loyalty program strategy for your business with our loyalty consulting services.

[1] Silk, R., 2019, ‘Airlines’ credit cards in “arms race” to profits,’ Travel Weekly, https://www.travelweekly.com/Travel-News/Airline-News/Airlines-credit-cards-in-arms-race-to-profits, accessed 26th May 2020.

[2] United Airlines, 2020, ‘MileagePlus Investor Presentation 15 June 2020’, https://ir.united.com/static-files/1c0f0c79-23ca-4fd2-80c1-cf975348bab9, accessed 23 June 2020.

[3] Catchit Loyalty, 2016, “How Frequent Flyer Programs Make Money”, YouTube, https://www.youtube.com/watch?v=-i50YVaD-tk, accessed 13th May 2019.

[4] Air France, ‘Air France FAQ’s’,https://www.airfrance.us/US/en/common/faq/flying-blue/how-long-do-your-miles-stay-valid.htm, accessed 25 May 2020

[5] Singapore Airlines Krisflyer terms and conditions https://www.singaporeair.com/registerKFUser.form?showTnC=y#:~:text=A%20member’s%20KrisFlyer%20miles%20will,in%20which%20they%20were%20earned. Accessed 26 August 2020

[6] Feldman, D., 2017, ‘LOYALTY MYTHS: IS BREAKAGE GOOD?’, Medium, https://medium.com/@dfcatch/loyalty-myths-is-breakage-good-873950da26dc, accessed 16 May 2019.

[7] Chandler and Tubman, 2012, ‘The Analytics of Loyalty – Qantas Frequent Flyer’, Actuaries Institute, https://www.actuaries.asn.au/Library/Events/FSF/2012/AnalyticsOfLoyalty3BChandlerTubman.pdf,accessed 15 May 2019.

[8] Chharbra, S., 2018, ‘Ontario’s reward points expiry ban is now in effect,’ https://mobilesyrup.com/2018/01/01/ontarios-reward-points-expiry-ban-now-effect/, Mobile Syrup, accessed 27 May 2020

[9] Moffitt, M., 2018, ‘Lock in your Velocity redemptions before the end of the year to avoid new charges’, Point Hacks, https://www.pointhacks.com.au/reduce-surcharges-frequent-flyer-programs-guide/, accessed 13 May 2019.

[10] Australian Accounting Standards Board, ‘Customer Loyalty Programmes, Compiled Interpretation, Interpretation 13’, https://www.aasb.gov.au/admin/file/content105/c9/INT13_08-07_COMPjun10_01-11.pdf, accessed 26 November 2010.

[1] Silk, R., ‘Airlines’ credit cards in ‘arms race’ to profits,’ Travel Weekly, Feb 2019 https://www.travelweekly.com/Travel-News/Airline-News/Airlines-credit-cards-in-arms-race-to-profits, accessed 26th May 2020

[2] Catchit Loyalty, “How Frequent Flyer Programs Make Money”, Youtube, 2016, https://www.youtube.com/watch?v=-i50YVaD-tk, accessed 13th May 2019.

[3] Air France FAQ’s https://www.airfrance.us/US/en/common/faq/flying-blue/how-long-do-your-miles-stay-valid.htm accessed 25th May 2020

[4] Etihad Guest Loyalty Program Review https://upgradedpoints.com/airline-loyalty-programs/etihad-guest-loyalty-program/, Upgraded Points, accessed 25th May 2020

[5] Feldman, David, ‘LOYALTY MYTHS: IS BREAKAGE GOOD?’ https://medium.com/@dfcatch/loyalty-myths-is-breakage-good-873950da26dc March 15th 2017, accessed 16th May 2019.

[6] Chharbra, S., ‘Ontario’s reward points expiry ban is now in effect,’ https://mobilesyrup.com/2018/01/01/ontarios-reward-points-expiry-ban-now-effect/, ‘Mobile Syrup, Jan 2018, accessed 27th May 2020

[7] Moffitt, Matt, “Lock in your Velocity redemptions before the end of the year to avoid new charges”, Point Hacks, 2018, https://www.pointhacks.com.au/reduce-surcharges-frequent-flyer-programs-guide/, accessed 13th May 2019.

[8] Customer Loyalty Programmes, Compiled Interpretation, Interpretation 13, Australian Accounting Standards Board, ‘https://www.aasb.gov.au/admin/file/content105/c9/INT13_08-07_COMPjun10_01-11.pdf,’ 26th November 2010.