Stop rewarding everyone. Start rewarding the right ones. Learn how DTC loyalty programs can drive predictable revenue, reduce churn, and scale profitably.

For most DTC brands, loyalty begins the same way:

- A plug-and-play loyalty app

- A points widget

- “Earn 5 points for every $1 spent.”

It feels like a milestone. A sign the brand is maturing.

But for many high-growth DTC companies, that’s where the problems start. Designing DTC loyalty programs requires more than installing ecommerce loyalty software.

Because loyalty is not a feature you bolt on. It’s a profit system.

In today’s DTC landscape, where margins are tighter, customer acquisition costs are higher, and subscription models dominate, the difference between a loyalty program that scales and one that erodes value often comes down to a single question:

Are you building true loyalty… or simply subsidising purchases that would have happened anyway?

The Plug-and-Play Loyalty Trap: Why Most DTC Loyalty Programs Fail

The loyalty market is full of tools that promise retention in a box.

Launch in a weekend.

Add points.

Offer discounts.

Watch repeat purchases rise.

The problem isn’t the technology. It’s the assumption that loyalty can be installed rather than architected.

Across platforms, Shopify, custom builds, enterprise commerce stacks, we see the same pattern: brands implement a standard earn-and-burn model with minimal customisation. The program goes live quickly. Reporting shows members spend more than non-members.

But that comparison is directional at best.

Member vs non-member behaviour is often influenced by self-selection bias. Your best customers are more likely to join your program in the first place.

Measuring True Incrementality

Member vs non-member comparisons are insufficient to determine loyalty program ROI.

Robust measurement includes:

- Control testing where feasible

- Observing behaviour persistence after incentives are reduced

- Reward cost as % of incremental margin

- Second purchase rate lift

- Subscription save rate improvement

- Liability growth vs revenue contribution

Without disciplined governance, loyalty can inflate liabilities without driving true growth.

The Loyalty Homogenisation Gap

In several DTC loyalty strategy audits we’ve conducted, a deeper analysis revealed that while loyalty members appeared more valuable, the actual incremental lift attributable to the program was marginal. In some cases, over 50-60% of the promotional and reward budget were given to customers who would likely have purchased regardless.

This creates what we call the Loyalty Homogenisation Gap: a sea of sameness where loyalty becomes a commodity, not a brand asset.

Another contributor to this gap is competitive mimicry. Brands review competitors’ programs and aim to build something “slightly better.” The result is often an incrementally improved version of an already flawed structure, easy to replicate and difficult to defend.

The Discount and Promotional Death Spiral

Discounts are powerful. Promotions, gift-with-purchase, sampling and tactical offers absolutely have a role to play in driving specific behaviours.

The issue arises when discounting becomes the primary mechanism for growth.

Discounts are immediate rewards. They stimulate immediate action, but their influence fades quickly. Repeated reliance on broad promotional mechanics can condition customers to:

- Wait for offers

- Buy only when prompted

- Engage transactionally rather than emotionally

Instead of strengthening margins, loyalty becomes a slow erosion of profitability.

A more sustainable approach balances immediate value with deferred value. For example, if a brand regularly offers 10–20% promotions, diverting even 5–10% of that budget into points or credits can preserve short-term stimulus while creating a reason to return. Immediate rewards drive response; deferred rewards build commitment.

We are strong advocates for intelligent promotional strategy. The objective is not to eliminate promotions, it is to deploy them surgically, within a broader behavioural framework.

True loyalty creates customers who stay, not customers who wait.

When Loyalty Doesn’t Scale

Poorly designed loyalty programs often begin to strain as DTC brands grow beyond early-stage revenue.

Suddenly the business requires:

- Custom behavioural triggers beyond purchases

- Zero-party data integration

- Subscription logic and cadence controls

- Segmentation by value

- Lifecycle orchestration across email and SMS

- Ownership of customer identity and reward economics

Rigid systems become bottlenecks.

One subscription-based brand we worked with had strong early loyalty engagement, but as the business scaled internationally, reward logic could not accommodate differing shipment cadences across markets. The result was friction, manual workarounds, and growing liability exposure.

The issue wasn’t ambition. It was architecture.

Loyalty Isn’t Points, It’s a Behavioural Value Exchange Engine

Before selecting tiers, currencies or perks, brands must define the job of loyalty.

At Loyalty & Reward Co, we define loyalty programs as behaviour stimulation systems, designed to intentionally shape actions, reduce friction, and enhance experiences in ways that create better outcomes for both the customer and the business. A true DTC loyalty strategy aligns behavioural loyalty with long-term customer lifetime value (CLV) growth.

Loyalty is not simply about “rewarding customers.”

At its best, it strengthens the relationship.

It reinforces habits, recognises progress, adds meaning to interactions, and enhances the journey beyond the core product or service. Commercially, this translates into:

- Improved second-purchase conversion

- Longer retention windows

- Stronger subscription continuity

- Increased share of wallet

- Reduced behavioural friction

- Greater revenue predictability

But loyalty cannot compensate for weak fundamentals.

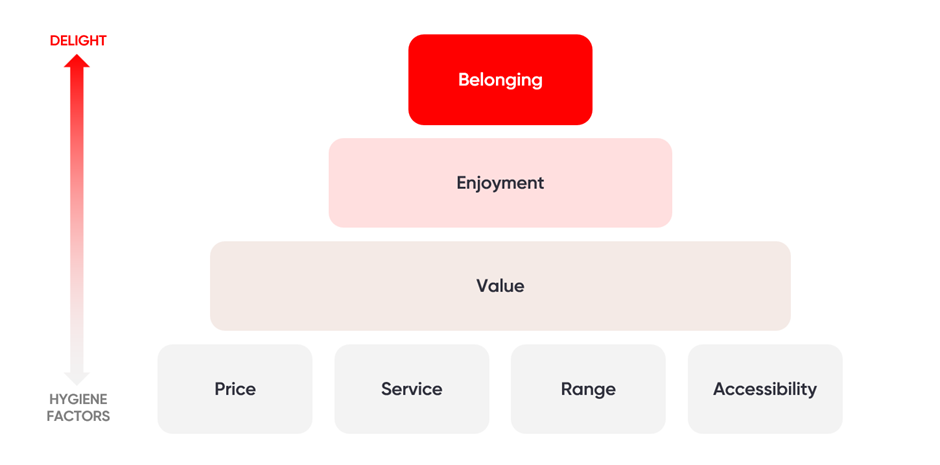

Price fairness, product quality, service reliability, range and accessibility are hygiene factors. They form the base of the experience. If these are broken, no amount of points or perks will fix the problem.

This is where the hierarchy of delight becomes useful.

Most programs operate at the value layer, offering economic benefits such as discounts or credits. Few progress to enjoyment (positive emotional engagement), and fewer still create belonging, identity, recognition, and community.

True differentiation lives above value.

The strategic question therefore is not, “What should we give customers?”

It is, “What behaviour are we encouraging? What friction are we removing? What higher-order value are we unlocking?”

Recognition matters. Incentives matter. But they must sit within a clearly defined strategy.

Giving customers “something extra” is not a strategy.

Designing an experience that strengthens commitment over time is.

This becomes particularly important in DTC subscription models, where confidence, control and continuity matter as much as economic value.

Subscription Loyalty Programs: Protecting Predictable Revenue

Traditional retail loyalty programs were built around foot traffic:

Come back to the store.

Spend more next time.

Earn rewards along the way.

DTC loyalty often supports continuity models:

- Autoship or auto-cart replenishment

- Subscribe & Save mechanics

- Bundled membership offerings

- Recurring delivery cycles

That means loyalty isn’t just about repeat purchase. It’s about repeatability. Subscription loyalty programs must support lifecycle confidence, not just autoship mechanics.

Subscription frequently selects already high-intent customers, it does not automatically create loyalty. Many customers stay because the product works, not because the subscription model feels seamless or reassuring.

The design question becomes:

How do we increase confidence and comfort in staying subscribed, not just compliance with the next shipment?

High-performing subscription loyalty programs reward behaviours such as:

- Staying subscribed

- Adding items to recurring orders

- Building purchase streaks

- Updating preferences

- Skipping instead of cancelling

Importantly, churn is a lagging indicator.

In many DTC categories, beauty, supplements, wellness, customers don’t abruptly churn. They fade. Shipment intervals extend. Delays increase. Basket size narrows. By the time cancellation occurs, disengagement may have been underway for months.

Loyalty mechanics should identify and respond to this fading behaviour early.

One brand we worked with reduced voluntary subscription cancellations not by increasing discounts, but by introducing flexible reward options tied to “pause” and “skip” actions. Confidence and control improved, and churn declined sustainably.

A loyalty program that trains customers to chase discounts can damage subscription economics. A loyalty program that builds reassurance can protect them.

The Essential Eight Principles of Modern Loyalty Design

Over decades of designing and analysing programs globally, we have distilled eight essential principles of best-practice loyalty.

If these are not present, scale eventually breaks the model.

- Simple: Easy to understand, join and engage with.

- Valuable: Delivers meaningful perceived value over time.

- Stimulating: Encourages ongoing engagement, not just transactions.

- Emotional: Builds identity, recognition and belonging.

- Complementary: Integrates seamlessly into brand and lifecycle strategy.

- Differentiating: Distinct within its competitive set.

- Cost-Effective: Balances customer value with margin protection.

- Evolving: Adapts as customer needs and channels change.

These principles form the foundation. Download a free copy of Essential Eight Principles guiding all best-practice loyalty programs.

Frameworks are the architecture.

Designing Loyalty Programs by DTC Category

There is no single “right” loyalty structure. Points, tiers, credits, referrals, surprise and delight, subscriptions, gamification and partner-funded models are all valid frameworks, when selected intentionally. The strongest DTC loyalty programs are rarely single-mechanic; they are hybrid systems, combining multiple frameworks to support specific behaviours across the customer lifecycle.

(For a deeper breakdown of loyalty program frameworks and how they differ, explore our guide to the core loyalty models here → Exploring 11 Different Types of Loyalty Program Frameworks)

But structure alone is not strategy.

Loyalty is not one-size-fits-all. Each category has different behavioural “math,” different purchase cycles, and different emotional drivers. Designing effectively requires understanding what actually drives repeat behaviour in your specific market.

Consumables (Beauty, Wellness, CPG): The Replenishment + Continuity Model

Loyalty is built around habit.

Key behaviours include:

- Subscription retention

- Replenishment cadence

- Add-ons within autoship

- Purchase streaks

- Preference updates

The goal is reducing churn and making repeat predictable.

Durables (Luxury, Furniture, Electronics): The Advocacy Model

Repeat purchase frequency is low.

Here, loyalty must reward advocacy:

- Referrals

- UGC

- Education

- Experiences

- Community participation

Durable loyalty programs succeed when they turn customers into ambassadors.

Apparel & Lifestyle: The Status + Access Model

In fashion and lifestyle categories, loyalty is identity-driven.

Customers value:

- Early access

- Limited drops

- Exclusive tiers

- Recognition

Belonging often outweighs discounts.

Services & Membership Brands: The Continuity Model

Service-based DTC brands thrive on:

- Paid tiers

- Bundled member benefits

- Touchpoint surprise

- Retention mechanics that encourage flexibility over cancellation

Here, loyalty functions as a retention engine, not a perk system.

The First 30–120 Days: Where Loyalty Is Won, and Where Churn Begins

As DTC brands scale, a familiar pattern often appears: a natural drop-off in the first 30–120 days.

The business usually knows it exists. Second purchase softens. Early subscription attrition rises. Engagement tapers. Some of this churn is inevitable. Not every customer is meant to stay. But the shape of that curve is not fixed.

For products used monthly or bi-monthly, the early lifecycle window determines whether customers develop confidence, habit and routine, or begin to disengage. Subscription mechanics alone do not create commitment. Nor do periodic promotions.

Churn often starts as behavioural fading long before cancellation: extended intervals, increased delays, reduced engagement.

This is where subscription retention strategy and habit formation intersect. This is where loyalty and lifecycle strategy matter most.

By intentionally reinforcing early usage, recognising milestones, reducing uncertainty and rewarding continuity behaviours, brands can meaningfully curve preventable attrition and build true behavioural stability.

The goal is not to eliminate churn. It is to ensure that avoidable churn, driven by friction or weak habit formation, does not go unaddressed. Because loyalty is rarely lost in year two; it is usually lost in month two.

Conclusion: Stop Rewarding Everyone

Most loyalty programs fail because they reward too broadly, discount too heavily, and differentiate too little.

The strongest DTC rewards programs are built on:

- Behavioural economics

- Category-specific design

- Subscription confidence mechanics

- Emotional engagement

- Margin discipline

- Scalable architecture

Stop rewarding everyone.

Start rewarding the behaviours that matter.

Design loyalty that protects your margins, strengthens your brand, builds confidence in commitment, and delivers measurable ROI.

Looking to Design or Re-Architect Your DTC Loyalty Program?

If you’re scaling a DTC brand and reassessing how loyalty supports retention, subscription confidence and long-term profitability, we can help. Get in touch with Loyalty & Reward Co to discuss your loyalty strategy.

From loyalty program audits to end-to-end design, we work with brands across categories to build loyalty strategies grounded in behavioural insight, commercial rigour and scalable architecture.