Brands are increasingly considering the adoption of card-linking and bank account-linking to supplement their loyalty program proposition for customers.

Banks, card schemes and major coalition loyalty programs are all investing heavily in the convergence of payments and loyalty to utilise major sets of data to unlock hyper-personalisation.

Given the significant potential to deliver a more seamless, rewarding customer experience, payment-linked loyalty is a trend which all forward-thinking brands should understand and consider.

What is card-linking?

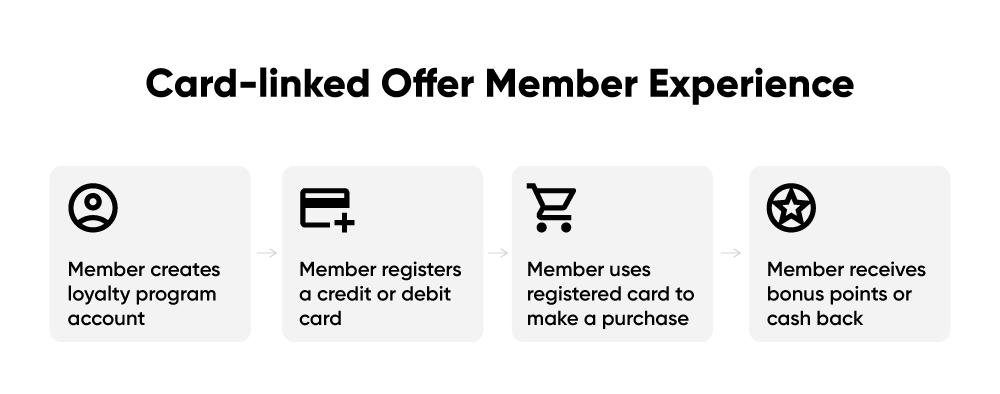

Card-linking technology allows customers to link their credit or debit card to another merchant.

Card-linked platforms have direct relationships with the major card payment providers (such as Visa, MasterCard and Amex) and allow retailers to set-up offers which can be linked to a consumer’s credit or debit card.

When a consumer spends in-store or online with a participating merchant using their registered card, the offer (such as cashback or points earn) is automatically triggered and applied without them having to also scan their membership card.

What is an example of card-linked loyalty program offers?

Within the loyalty industry, card-linking technology is often used to enable card-linked offers.

Brands which incorporate card-linking enable members to engage with a loyalty program and promotions without the need to present a separate form of identification (such as a loyalty membership card).

For example, a hospitality company may allow members of their points-based loyalty program to link a credit or debit card to their account, enabling them to automatically earn and accumulate points for every transaction made within the company’s set of locations. From a user’s perspective, they simply make an order at the point of sale, pay with their linked card and are notified of a successful transaction and the points earned.

Card-linking adds a new layer of convenience to the customer experience and can resolve several additional friction points, including instances where members forget their loyalty card or mobile app login, or simply do not know they are entitled to an offer at a specific merchant.

What is bank account-linking?

Bank account-linking platforms access authorised feeds of transactions directly from member bank accounts.

This approach is more comprehensive than card-linking because it can provide a greater view of transaction data, not simply from a specific card at specific retailers.

For example, a card-linked network may only have ten merchant partners and therefore only gather insights inside the network. Bank-linking eliminates this network limitation and also mitigates card scheme transaction fees.

Brand benefits of bank account-linking

For a program operator, bank account-linking offers greater access to more detailed member transaction data. Captured data is no longer restricted to partners within a specific customer experience – a key advantage over card-linking.

When brands correctly use this data, they can deepen their understanding of cross-channel spend behaviour and properly profile customers. Such insights enable better targeting, personalisation and campaign efficacy. This presents brands with a new opportunity to create better engagement and recognition of members.

Other significant benefits of bank account-linking for brands include reduced settlement times and reduced costs due to the removal of interim payment partners. These can also directly benefit consumers, whereby more value can be provided back to customers to further drive engagement and spend.

Consumer benefits of bank account-linking

The primary consumer benefit is that bank account-linking delivers a more effortless user experience.

Members receive access to hyper-relevant offers based on their behaviour, even if they do not pay with a specific credit or debit card, which ultimately helps them save money on everyday purchases. A brand that can offer a better experience for the end-user is always viewed more favourably, and this ultimately becomes the new expectation.

Open banking to drive payment-linked loyalty

Technologies enabling bank account-linking have advanced significantly thanks to the open banking revolution.

Early forms of bank-linking were cumbersome and slow, often requiring several months of integration work for a single partner. Ongoing management required lots of resourcing and manual work, while an imperfect customer experience did not warrant the effort. Today, open banking is enabling the ability to access complete transactional data in an instant.

Benefits aside, consumer adoption at-present is low. This is mostly due to a widespread challenge of consumer trust. Since the early days of the internet, banks have warned customers to never share banking information. The result is a societal norm where most individuals are uncomfortable with an external party requesting access to their bank account.

With that said, the growing advancement of open banking practices globally will ultimately lead to bank account-linking acceptance and adoption; major societal changes take time, and market leaders usually benefit. A similar scenario occurred with online payments – people weren’t always open to the idea of entering payment details into a website – today, most people don’t think twice when paying at the online checkout.

Consumer trust and confidence is won through great products. From a loyalty program design perspective, the member experience needs to be worth the trust. If a member can clearly see the value and benefit of linking a bank account, they are more likely to participate.

Examples of card-linking and bank account-linking

CommBank Rewards

Another example is CommBank Rewards, a card-linked cashback offer program available to customers of multinational bank CommBank. Customers are presented with 12 tailored cashback offers in the app each fortnight from different brands. They can click to activate the offers. When they spend with their CommBank credit or debit card at the brands, they earn cashback directly into their account.

Bits of Stock

Bits of Stock is a mobile app and website browser extension which uses card-linking and bank account-linking technology to allow members to earn fractional share/stock rewards when they shop with participating brands. For each purchase, members receive a percentage back in the form of shares which is funded by the brand partners. The percentage is different for each participating brand, and some have extra bonus earn opportunities.

Woolworths Everyday Rewards

One example of card-linking is supermarket giant Woolworths with the Everyday Pay wallet to support their points currency program. Members can register a preferred credit or debit card to their account via the Everyday Rewards app. Once a card is linked, members simply need to scan a QR when paying for their groceries to automate the payment process, and in doing so, the points earning process.

Loyalty & Reward Co have previously covered other brands utilising payment-linked technologies to better the program experience, including Beem and CapitaStar.

Future use cases of open banking for loyalty programs

Open banking-enabled loyalty programs and apps will open up a whole new world of possibilities for brands to personalise the individual customer experience. The technology will also enable a seamless, single payment solution which will save time for customers at the point of sale. This is why some industries may be positioned to leverage the technology.

Below is a few potential uses cases of open banking and bank account-linking, with the assumption that the individual member has already linked their bank account to the loyalty program.

Retail and FMCG

Member X of major grocery/supermarket chain walks into the store and immediately receives a notification of personalised bonus point offers. The member activates relevant offers and begins to shop. At checkout, the member scans all their items and a QR code. The payment and all eligible offers are automatically processed as they walk out. As a bank-linked member, they always receive extra points for each shop.

QSR/Fast Food

Member Y of global fast-food chain receives a lunch time drive-through special on Thursday. This has been triggered based on habitual lunchtime insights inferred from the member’s bank history (e.g., likelihood of purchasing a lunchtime meal, average price point, preferred time, preferred day to purchase a meal versus not). The member’s stomach is delighted by the well-timed offer so the member confirms the order for 20 minutes time. The member enters the drive-through pick up lane and quotes their membership to receive their order. Both the member and employee confirms the pick up, instantly processing the payment with one touch. The member drives home to eat lunch.

Telecommunications

Member Z of a national telecommunications company is on holiday for three weeks, and has made several holiday-related transactions, including flights, accommodation, activities and everyday travel expenses. The telco company uses the data to determine when the member has returned home, as well as improve the general profile of the individual. Later, Member Z receives a communication about their monthly mobile plan bill and notices a significant discount during the period they were away. The communication includes acknowledgement of the discount as a gesture of goodwill, and also includes a few personalised partner offers for the member to consider next time their away.

The future of payment-linked loyalty

While open banking will likely change the face of loyalty programs in the near future, the convergence of payments and loyalty may have far greater impact.

Payment linked loyalty (or asset linked loyalty as it may be referred to) could ultimately be a way for customers to link any form of payment method to a brand’s loyalty program. A payment method should be thought of as any asset source – a credit or debit card, a bank account, loyalty account points, shares, any digital payment source such as PayPal and even crypto wallets.

The future for payments and loyalty is one in which customers have choice over how they pay and interact with a brand for goods and services. This will influence the type of experience they have when using their payment profile – from whether they get cashback or an alternative reward on their purchases, to what personal information is shared as part of each brand-customer interaction.

The future of payment-linked loyalty will help merchants unify their customers’ identity, assets and experiences. In order to achieve this goal, brands need to become more transparent about how they treat consumers’ data in order to improve trust with all stakeholders involved in the transaction: customers, merchants, suppliers and regulators alike.