I am regularly exposed to trends, themes, generalisations and buzzwords regarding the current and future state of loyalty in my day-to-day with clients, at loyalty events and in loyalty media. Data, personalisation, customer relationships – but behind all the fluff what does it actually mean for consumers and brands?

I’ve chosen to write this as an opinion piece as I think it is important to form your own opinions after reviewing the available evidence. Sometimes you will find holes in the logic (like Michael Burry in the “The Big Short“) and at the very least you will gain a better understanding of the concept. Without going through this exercise we are regurgitating others’ opinions and conforming to groupthink, which is defined by Oxford Languages as the practice of thinking or making decisions as a group, resulting typically in unchallenged, poor-quality decision-making.

This opinion piece attempts to pragmatically challenge loyalty generalisations and assumptions (in the form of four statements) I’m seeing and hearing both day-to-day professionally and as a consumer.

Statement #1: Consumers want to use a mobile app

Mobile app real-estate is competitive. Consumers regularly remove apps they see no value in relegate them from the homepage, making them out of sight, out of mind (especially if notifications are disabled). There are also many app categories used daily by a large portion of the population. Below are popular app downloads which loyalty apps must compete with for space and attention.

| Category | Examples |

| Music and podcasts | Spotify, Apple Music & Podcasts, Soundcloud |

| Health and fitness | Mindfulness, workout, wearables |

| News | WSJ, BBC, ABC |

| Productivity | Reminders, lists, Google and Microsoft suite |

| Travel | Uber, local transport schedules |

| Finance | Banking, Investment, expenditure splitting |

| Social media | Instagram, Twitter, Snapchat |

| Entertainment | YouTube, Sudoku, Wordle |

Plenty of competition for attention.

Whether an app is a good idea also depends on who your customers are. Some consumers prefer a physical membership card to identify themselves, which is usually the case for older demographics. Some prefer using Apple and Google pay to identify, which doesn’t necessarily require an app for facilitation and is preferred by people on-the-go.

The cost (financial, time investment and opportunity cost) of delivering an app is significant, therefore, careful consideration should be made before making such an investment. Do your customers actually want an app from you? What is the purpose of the app? What are the alternatives to an app? If you have an app, how is it performing? Do many customers use the app regularly? Do customers enjoy using the app? These are all important questions.

Bottom line

Yes, if your app is valuable and enhances the experience for customers you will likely earn your place on their phones. If this seems unachievable or unlikely it is probably best to look at other options.

Statement #2: When provided with a reward, customers are willing to share data

Friction (or the possibility of friction) during the program join process is a factor weighing on consumers’ join decision criteria. The time and effort required to sign up for some programs simply outweighs the perceived benefit. Big tech (Apple and Google) has reduced friction by creating automatic field fillers, automatic inputs for SMS codes and the storage of payment card details, benefitting programs. Many programs also provide a ‘join bonus’ to further alleviate the reluctance towards signing up.

However, there are other factors consumers care about. One being the risk their email address or mobile number is shared with unwanted 3rd parties. Another is the risk they will be spammed with communications, which unfortunately happens all too often.

A reward may encourage a portion of customers (choosing the right rewards), but reducing friction and building a trustworthy brand reputation is also important. Offering social sign-in (e.g., sign-in with Apple or Facebook) is a great way to reduce friction while still collecting the data required to run the program. There also needs to be a clear value proposition for signing up to the program beyond the join bonus, otherwise the member’s participation will be short-lived.

Bottom line

Yes, rewards definitely help influence joining a program but a compelling value proposition, trustworthy brand and frictionless experience are also determining factors.

Statement #3: Customers want a personalised approach

I agree that most consumers want to see content relevant to them. Who wants to see fried chicken content from a QSR as a vegetarian, puffer jackets going into Summer or female leggings as a male – there may be some exceptions to these examples, but you get the message.

Most program managers attempt to tailor the experience to individual consumers by personalising offers, marketing content and rewards. However, they need a reasonable amount of customer data to make accurate assumptions. The more data the higher the chance the content delivered will be of the consumer’s taste. Spotify collect hundreds of datapoints for most users daily, whereas a bedding company may only collect a handful of datapoints over a ten-year period.

Once you have the data, you need the engine to power the personalisation. This can prove challenging to get right and not all personalisation engines are created equal. Careful consideration to the input assumptions and the content to be excluded is important. A common assumption is that consumers who purchase an item will want to purchase the same item again. This may be the case sometimes, but definitely not all the time. In grocery, Sainsbury’s (Nectar) in the UK and Woolworths in Australia serve up offers for products I purchased as a one-off, but not for some of my regular purchases. From a commercial perspective, why would you provide an offer for something that the consumer will buy anyway? But from a consumer perspective it is annoying. Amazon have a ‘Buy it again’ feature but it’s highly unlikely I’m going to want the exact same coffee table I recently purchased.

There are also varying levels of personalisation. One-to-one personalisation (content unique to the customer) is very different to segmented personalisation (content assigned to customer groups) so it depends how far you want and can take it.

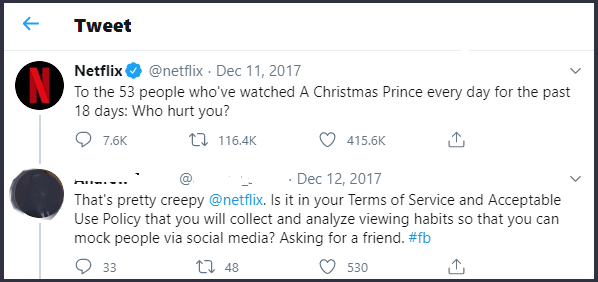

Organisations also risk taking personalisation too far, making customers uncomfortable. Personalised content can reveal how much a brand knows about a customer. If the delivery is not considered, this may be seen as an invasion of privacy or just downright creepy for some consumers.

Bottom line

Yes, most customers do want a personalised approach. The power of personalisation lies in the data quality, the setup of the personalisation engine and the communication.

Statement #4: Customers want a relationship with the brand

The design and delivery of survey and focus group questions during market research can impact the answers we receive from subjects. If the answers received are not accurate, the insights extracted are not accurate and the brand will make decisions based on inaccurate information. This article outlines how to avoid poor design and delivery – five common market research pitfalls (and how to avoid them).

Recently, several brands have extracted a similar insight from market research, “our customers want a relationship with us!”, which leads me to be sceptical. Customers already have somewhat of a relationship with the brand by simply being a customer. So, what does a relationship mean in this context? Does it mean these customers want to make repeat transactions or does it mean that they want to attend brand events and receive newsletters?

There are three variables in the above statement – the customer, the relationship and the brand. The combination of the three will determine whether the customer wants a relationship.

The brand. Is it a brand consumers know and use? Is it a brand that consumers are emotional towards? For example, Intel provides products most consumers have heard of and use, but no one wants a close relationship with a computer processor. On the other hand, consumers are more likely to feel strongly towards Microsoft who provide software and hardware they know and use. Why is that? It may be visual. Consumers see the Microsoft logo as they start up their computer, they see the Microsoft 365 suite (Excel, Word, PowerPoint, etc) daily, whilst Intel sits in the background often brought up initially as part of the sales process and never heard or thought of again.

The extent of the relationship. What type of relationship do consumers want with a brand? It’s not going to be the same relationship that you would have with a spouse, family member or friend – that would be strange. I’m not saying a brand relationship is the same as a human relationship although maybe there are some similarities. Similar to the relationship with a postman, a grocery store could build a relationship as a provider. Similar to the relationship with a firefighter, an insurance company could build a relationship as a protector. And, similar to the relationship with a friend that turns sour, a retail brand can degrade their relationship by frustrating a consumer. It is about not overstepping and knowing your role in the consumer’s life.

Lastly, the type of consumer. Consumers can be segmented in an infinite number of ways, the only limitation being the data the brand has available. Speaking generally, the type of consumer that wants anything above a baseline relationship with a brand is already interested or passionate about the category of products or services provided. If a consumer does not have a genuine interest in electricity generation and supply, they’re probably only interested in a service-oriented relationship with their energy provider rather than an emotional one – that’s not to say it cannot be done by acting in the interest of customers, supporting them during tough times and providing an excellent service.

Bottom line

No, in most cases. Not the relationship that most brands believe the customer wants anyway.

Hearing this internally?

We welcome your thoughts and challenges. Contact us to challenge, discuss, ask questions and understand how to optimise your loyalty program strategy.

Our loyalty consultants have helped global brands take the critical steps to design effective loyalty programs, as well as support ongoing evolution to meet changing business and consumer expectations.